EQUITYBASE - Global Real Estate Investment Industry based on Blockchain Technology

Preliminary

Used in investment or trading when buying base capital tokens at an equivalent cost, without bearing fees on our platform. Participants around the world will be able to use our platform for investment and diversification of their portfolio, along with liquidity in the market, but generate private market revenues. With the support of our specialists with extensive experience and reputation in the field of real estate, consumer electronics and the high-tech industry, we at Equitybase raised $ 300,000 of round seeds. We created and issued a high profile on the companies website, with extensive experience in real estate and operating start-ups over the past 15 years.

By the summer of 2018, the full functionality will be launched on our Equitybase platform. Where any participants will be able to invest in shared commercial real estate and receive dividends from the lease, we roll with the satisfaction of the asset that will be passed perfectly on the contract and paid off the crypto or fiat currency along with the liquidity of the traditional public markets. By the fall of 2018, iOS and Android will be available to our platform users also, with the full functionality of our site reliably on their mobile devices.

In a simpler language - a real estate exchange based on blockchain

What are the current investment model problems?

Liquidity to Private Markets (Equity investment has a lengthy lock-up period of 3-10 years)

Availability of Financing (Developers will only be able to obtain financing from within the country)

The cost of the loan (the interest rate depends on the region and the own funds of the developers will be significant)

Barrier entry (Commercial investment requires a huge amount of start-ups)

Low Level of Return (the stock market for the last 10 years averaged 7% of profit per year)

High Management Fee (Private capital management fees range from 2-4% per year)

What solution does the team of this project offer?

World Access (Developers from around the world will be able to post their projects on our Equity Invest platform and raise sufficient capital with ease)

No Minimal Investment (The investor can invest any amount of his choice without limiting the minimum investment)

Credit Rating System (Investors can track performances and track record developer)

Liquid Investments (Our Exchange platform offers the flexibility for investors to liquidate their assets for any investment)

Zero Investment Duty (the basis of the holder of the token will be able to use the platform without any commissions when dividends are received on the Joint Stock Fund)

Dividends and target profitability (The volume of investments in commercial real estate offers high profitability and dividends of the database for any class of assets around the world)

Road map:

3КВ / 2017

- Formation of the Company

- formation of equitybase

- Team formation. The first steps in the development of the architecture of the platform are equitybase.

4kV / 2017

- Financing

- Development

- Starting Capital: $ 300,000

- Start developing a platform

1Q / 2018

- Crowdsale

- Individual Pre-sale

- Pre-IKO

- Public IKO

- Demo version of the platform will be released

- Front-End and Back-End development, API testing

2КВ / 2018

- Dividends

- Platform Release Platform

- beta version Equity Invest

- Exchange of the base marker list

- Aggregation of liquidity from several exchanges Crypto currency is created

3КВ / 2018

- Development

- Acquisition of users

- Launch of the Mobile Application

- Partnership and attracting users

- Credit rating and detailed reporting, integration

4kV / 2018

- Expansion

- Establish a regional office in London, Shanghai

- Expansion of proposals for hedge funds and private equity funds

- Equity fund IKO

- Converting direct FIATA money

Tokens:

Marker symbol: BASE

Common delivery marker: 360,000,000 BASE

Rigid Restriction: $ 50.4 Million.

Marker Price: $ 0.28

Minimal purchase: No

Reception: Ethereum, Bank Transfer

ERC20 marker: yes

Individual Cover: None

Countries are allowed: Equitybase does not exclude people from any countries from participating in our IRS. We, residents, citizens, and Green Card holders need to confirm their rights as accredited investors. All participants are invited to visit the relevant country / region to regulate the IKO. As an alternative to the provision of financial documents, US investors can be accredited if they can provide evidence that they have at least $ 1mm of crypto currency at the enterprise.

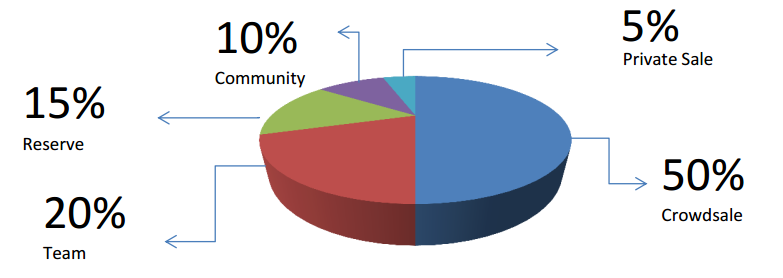

Distribution:

180mm (50%) bases should be allocated to the base of the sale of the marker.

72 mm (20%) of the grounds for entering into a wallet with a multi-signature and spent Equitybase for long-term investments and network updates.

48MM (15%) base will be used for backup

36MM (10%) of the grounds should be allocated to bounties and community-based, including consultants, home partners on the equitybase platform.

18mm (5%) from the base offer for private pre-sale

Command:

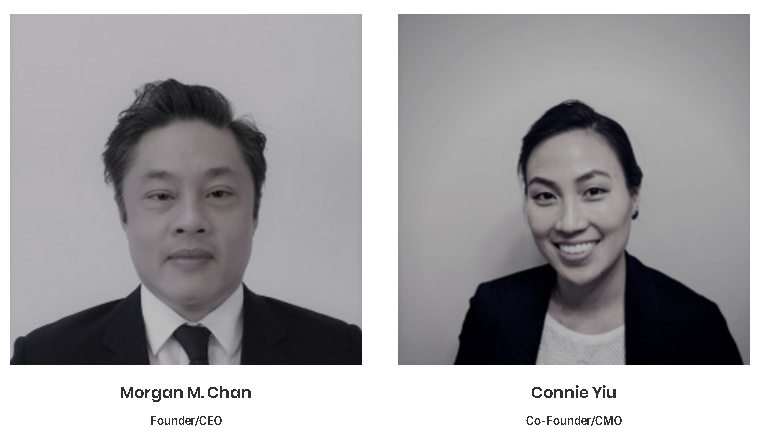

MorganM . Chan

Founder / CEO

General partner Sapphire capital of commercial real estate development company with $ 100 million under management. He started to work and several IT and consumer electronics since 2000.

&

Connie Yiu

Co-founder / Marketing Director

Earlier in the dollar shaving club as a manager of social networks, regulates all aspects of social marketing. DSC acquisition by Unilever in 2016 for $ 1 billion. Before DSC, she was at newegg, as a marketing manager.

Lee Lois

Chief Legal Adviser

Website: https://equitybase.co

White Paper: https://equitybase.co/equitybasewhitepaper1.pdf

Twitter: https://twitter.com/equitybaseco/

Facebook: https://www.facebook.com/equitybase/

Telegram: https://t.me/equitybase

Medium: https://medium.com/equitybase

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1409779

Komentar

Posting Komentar